Ethereum Price targets $3,500 amid Liquidity Staking Boom

02/27/2024 18:31

Ethereum market data analysis explores how the recent spikes in liquidate staking derivatives like Lido's (StETH) could impact ETH price rally.

ETH price reached a new 3-year peak of $3,274 on Feb. 27, a rare dynamic observed in the liquidity staking derivatives (LSD) markets could drive it even further.

Lido (StETH) price has outpaced Ethereum in each of the last 4 trading days as ETH 2.0 re-staking emerged as the leading theme for the ongoing Ethereum price rally. Historical trends and beacon chain activity provide insights into how this could impact ETH price action in the days ahead.

Liquidity staking derivatives (LSDs) set new record amid ETH price rally

Ethereum’s transition to the proof of stake consensus in 2023, gave rise to the emergence of Liquid staking derivatives (LSDs) —tokens that represent staked cryptocurrencies.

LSDs serves two critical purposes. First, they give investors access to the liquidity of their staked ETH coins while they are locked up on the beacon chain, thereby mitigating the opportunity cost. Second, they facilitate the participation of retail investors who are unable or unwilling to meet the 32ETH liquidity requirement and technical complexities of running a node.

Leading LSDs like Lido (StETH) and Rocket Pool (RETH) are pegged to ETH prices. However, during times of intense market demand, the real-time prices of these tokens marginally prod above ETH price. This rare market phenomenon has been observed in the last 4 trading days, the longest streak since the Proof-of-Stake transition in 2023.

The chart above shows that since Feb. 23, the prices of liquidity staking derivative tokens have raced past ETH, signaling rising demand for passive income among Ethereum investors.

Lido (StETH) price has closed above ETH in 3 consecutive trading days, a rare market dynamic that has often historically preceded ETH price upswings.

Ethereum beacon chain contracts received 205,085 ETH over the weekend, further affirming the bullish outlook.

ETH stakers make $740m beacon chain deposits in 3-days

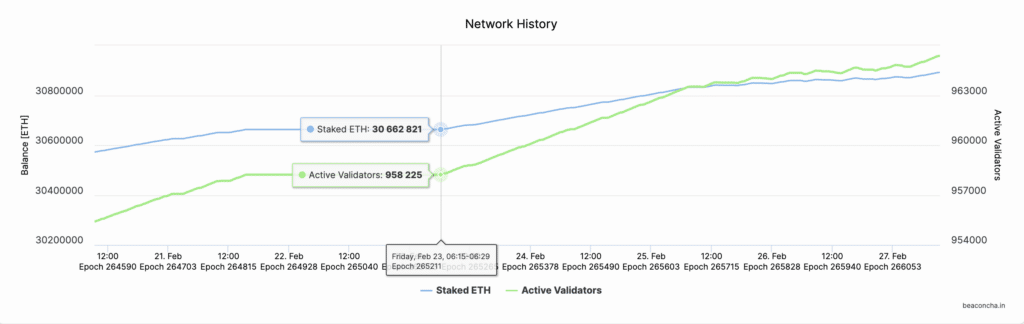

As per official data from the Beacon chain, only, 30.7 million ETH were now locked up in Ethereum beacon chain staking contracts as of Friday Feb. 23. But interestingly, at the close of Feb. 26, investors have deposited another 228,117 ETH, bringing the total stake to 30.9 million mark.

With ETH price currently trading above $3230, at press time on Feb. 27, the newly-stake coins over the last 3-days are worth approximately $740 million. For Ethereum’ short-term price action, this steady increase in ETH 2.0 staking is bullish for a number of reasons.

Firstly, it improves the PoS network’s security and efficiency which is crucial during periods of high market activity. More importantly, it temporarily reduces the number of coins readily available to be traded on the open market.

The rise in demand observed on LSDs like Lido suggests that the majority of the ETH staked coins could remain out of circulation for a longer period. By obtaining StETH, users get to optimize their passive income and participate in DeFi activities, in addition to the 4% APR from the beacon chain.

Given the prevailing bullish sentiment surrounding the crypto markets, these crucial factors could combine to accelerate the ETH price rally toward the $3,000 mark in the coming weeks.

Ethereum price forecast: $3,360 is the next major roadblock

In summary, market scarcity induced by the rising staking deposits puts Ethereum price in prime position for an accelerated rally toward $3,500. However, in the short-term, the bullish traders face a major roadblock at the $3,360 territory.

IntoTheBlock’ global in/out of the money (GIOM) data groups all existing ETH holders according to their historical entry prices. Currently, it depicts 1.2 million addresses that acquired 579,890 ETH at the average price of $3,366.

This cluster of holders could mount a roadblock if they opt to book some profits as Etherum prices approaches their break-even point.

However, if the bulls can stage a decisive breakout above the $3,360, a $3,500 retest could be on the cards as predicted.

On the downside the bears could negate this optimistic prediction if Ethereum price reverses below $3,000. However, as seen above, the 1.9 million addresses that acquired 1.8 million ETH at a minimum price of $3,037.

To avoid slipping into losses, those investors could cover their positions, and possibly, trigger an instant rebound.