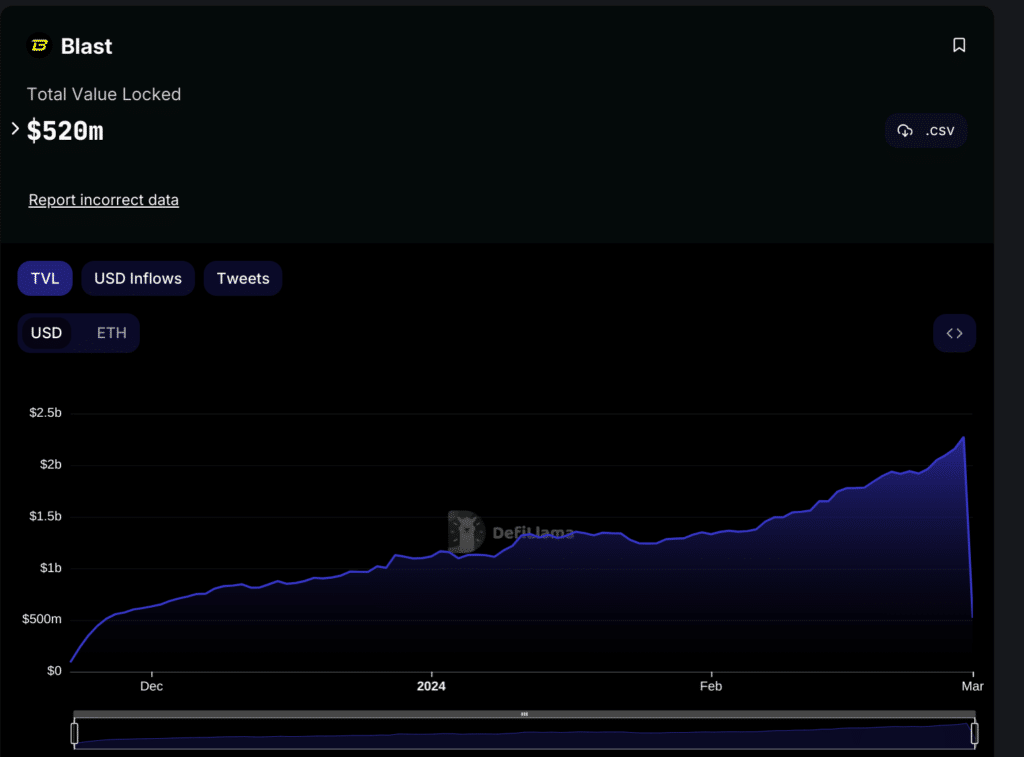

The Blast blockchain, a layer-2 network on Ethereum, saw investors withdraw $1.7 billion of initially staked Ether.

According to data from DeFiLlama, the withdrawals, constituting the majority of assets, occurred within the first 24 hours post-launch. Blast had attracted attention by promising native yield on the Ethereum (ETH) L2, accumulating over $2 billion in deposits before going live through a mechanism known as points farming.

Despite the initial frenzy, the network experienced significant outflows, with the balance of the Blast bridge contract dropping by about 70%.

However, not all funds are exiting the network, as a portion is transitioning into Blast’s ETH Yield Manager Proxy, indicating a movement of capital within the ecosystem.

The launch was not without its controversies, as an optimistic rollup design necessitates a 14-day waiting period plus Ethereum gas fees for withdrawals back to the mainnet, a detail some investors claim to have been unaware of.

Additionally, the network has already seen its first exit scam, with the protocol named ‘RiskOnBlast’ vanishing along with $1.3 million worth of Ether.

Blast’s journey from a deposit-gathering initiative to a live network has been polarizing. While some critics likened its deposit-only bridge to a pyramid scheme, proponents have lauded its potential to enhance Ethereum’s scalability.

Despite these challenges, Blast has retained significant deposits, potentially positioning it as the third-largest layer-2 network on Ethereum.

The project, backed by Paradigm and spearheaded by NFT decentralized application Blur founder Tieshun Roquerre, has been both a marketing success and a target for criticism due to the delays in transitioning from a concept to a functional project.

With over 85,000 accounts in its Discord community and 57,000 wallets interacting with the chain since its launch, Blast’s ecosystem continues to expand, even amid concerns over the viability and security of new projects within its fold.