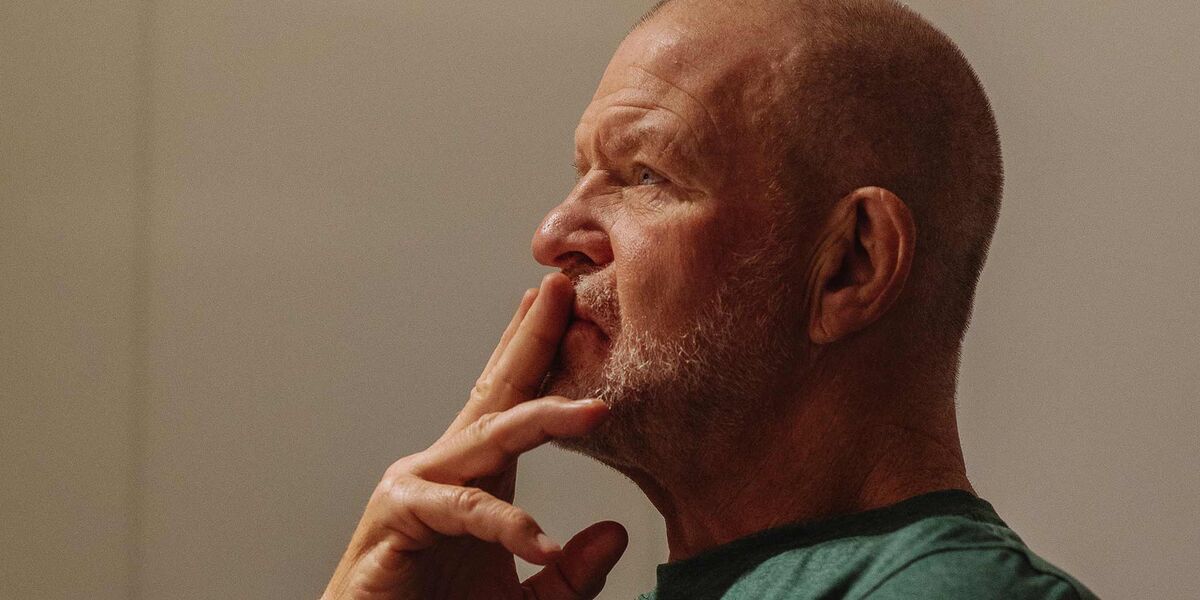

With the 10-year Treasury yield peaking at 5% on Thursday, compounded by Federal Reserve Chair Jerome Powell's comments on higher for longer interest rates, investors are unsure where to park investments during a turbulent market. Oppenheimer Asset Management Chief Investment Strategist John Stoltzfus joins Yahoo Finance to break down how the markets are reacting to historic peaks in interest rates and bond yields, as well as offer insight to what investors should keep in mind during these developments. "We also think you need to be in the industrial sector, industrials today are not just a lot of machinery but a lot of technology, whether its in energy generation, in aerospace commercial and defense, or as it relates to retail establishments and eCommerce," Stoltzfus says. He additionally affirms his belief in American consumers continuing to be robust in their spending: "We don't believe in betting against the American consumer. I've been in this business for 40 years and the American consumer spends like a sailor on leave... during good times and during tight times... they still shop." For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.