SUI vs Solana [SOL]: How $7.5B in DEX volume changed the game

11/08/2024 13:00![SUI vs Solana [SOL]: How $7.5B in DEX volume changed the game](https://ambcrypto.com/wp-content/uploads/2024/11/News-articles-FI-Samyukhta-5-1000x600.webp)

SUI Network has surpassed Solana in DEX trading volume, hitting $7.5 billion in transactions with innovative technologies and strong growth.

![SUI vs Solana [SOL]: How $7.5B in DEX volume changed the game](https://ambcrypto.com/wp-content/uploads/2024/11/News-articles-FI-Samyukhta-5-1200x686.webp)

- SUI’s DEX volume has surpassed Solana’s, reaching $7.5 billion and drawing investor interest.

- Powered by tech advancements, SUI’s rapid growth positions it as a strong blockchain competitor.

SUI Network has surged ahead of Solana [SOL] in decentralized exchange (DEX) volume, amassing an impressive $7.5 billion in transactions.

This rapid growth has turned heads across the crypto space, sparking fresh interest from investors eyeing SUI’s potential.

As its ecosystem expands with new projects and enhanced functionalities, many are wondering: could this momentum drive SUI’s price higher?

Key factors behind SUI’s growth

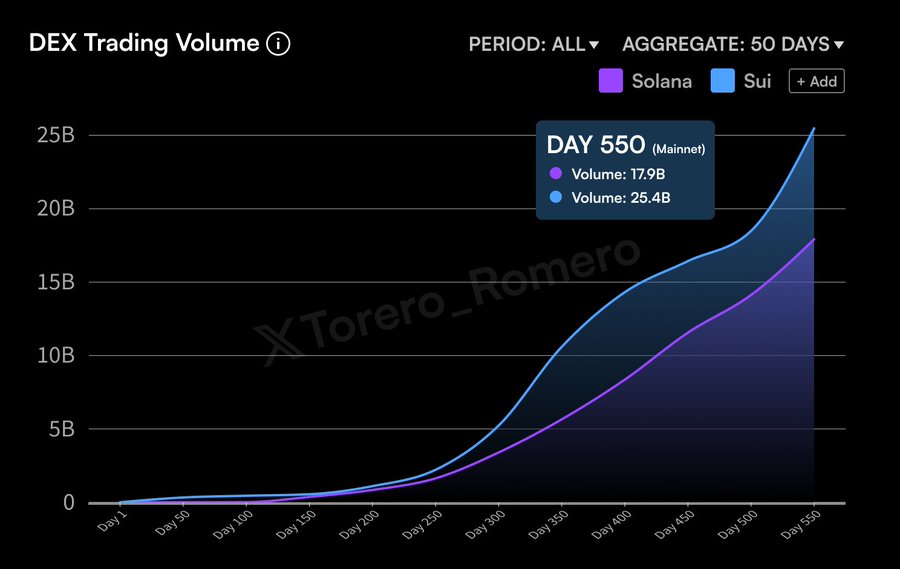

When comparing DEX trading volumes, SUI has shown a stronger growth trajectory than Solana.

Over a 550-day period, with data aggregated every 50 days, the former’s trading volume reached 25.4 billion, surpassing Solana’s 17.9 billion.

Both networks have increased in user activity, but SUI’s growth rate accelerated around day 300, suggesting significant traction and potential outpacing of Solana in trading activity.

SUI’s DEX volume surge can be credited to its recent advancements.

This included the launch of the Mysticeti consensus engine, which boosts transaction capacity, and its integration with Google Cloud for scalable, secure application deployment.

How price responded to DEX growth

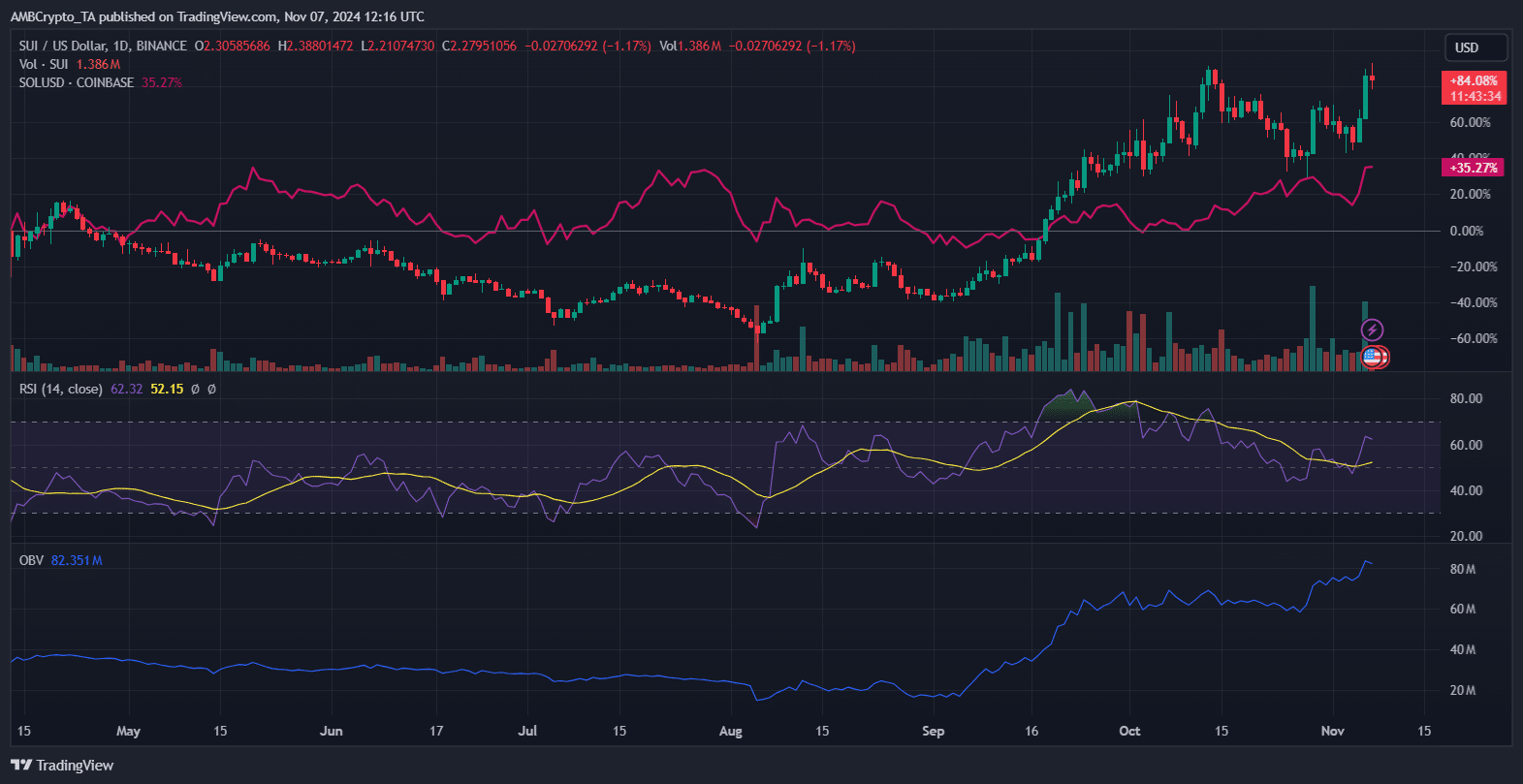

SUI has shown strong price performance, reflecting its recent dominance over Solana in DEX volume. Trading around $2.30 at press time, it has achieved an impressive 82.80% gain over recent months.

In comparison, SOL’s price increase over the same period was 35.64%, indicating that SUI was outperforming Solana considerably in terms of investor interest and market momentum.

Its trading volume has also spiked, suggesting increased activity and buying interest.

SUI’s RSI stood at 61.61, signaling strong buying momentum, but still below the overbought threshold, which could indicate room for further upside.

The OBV also shows a steady upward trend, pointing to strong accumulation.

Read Sui [SUI] Price Prediction 2024-2025

This price momentum aligns with SUI’s increased DEX volume — signifying growing utility, investor confidence and potential price appreciation.

Overall, SUI’s strong price rally, driven by its growing DEX dominance, suggests a promising outlook for further gains.