BTC vs ETH ETFs: Why investors are favoring Bitcoin right now

01/14/2025 11:00

BTC and ETH ETF trends diverge as Bitcoin spot ETFs gain $307M in inflows, while Ethereum ETFs see $186M outflows.

- Bitcoin ETFs shine with $307M inflows, overshadowing Ethereum’s $186M outflows.

- Shifting trends hint at growing BTC dominance over ETH in ETF markets.

Investor interest in crypto-focused ETFs has taken center stage as Bitcoin[BTC] and Ethereum[ETH] show contrasting trends in fund flows. While Bitcoin spot ETFs enjoy significant inflows, Ethereum ETFs grapple with notable outflows.

This divergence reveals shifting investor sentiment and raises critical questions about the factors driving these dynamics.

BTC ETFs: A beacon of strength?

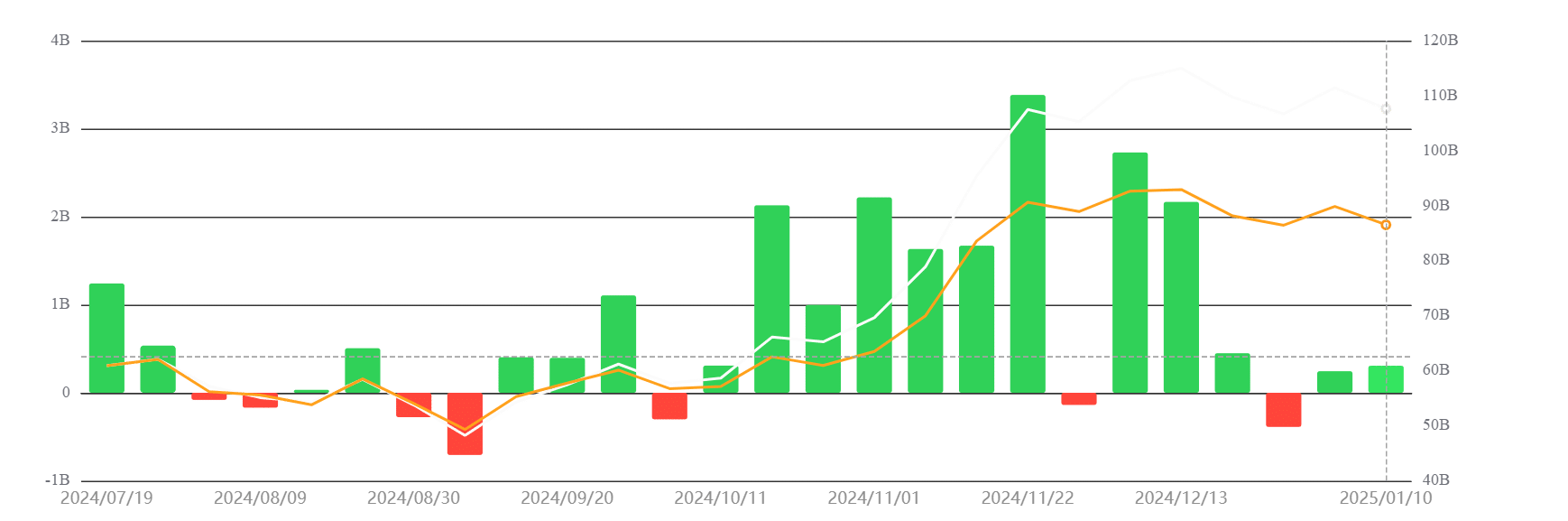

Bitcoin spot ETFs saw remarkable inflows of $307 million last week on the 6th of January, reflecting heightened investor confidence in the leading cryptocurrency. BlackRock’s IBIT ETF emerged as the standout performer, pulling in $498 million.

This strong performance highlights the growing appeal of Bitcoin as a reliable store of value, particularly as macroeconomic uncertainties persist.

However, not all Bitcoin ETFs shared this positive momentum. The Ark & 21 Shares ARKB ETF experienced a net outflow of $202 million, indicating that while institutional inflows drive the overall trend, some funds face challenges in retaining capital.

Analysis of the chart illustrates the consistent rise in Bitcoin ETF inflows, showcasing BlackRock’s pivotal role in steering the market.

ETH ETFs: A struggle to keep up

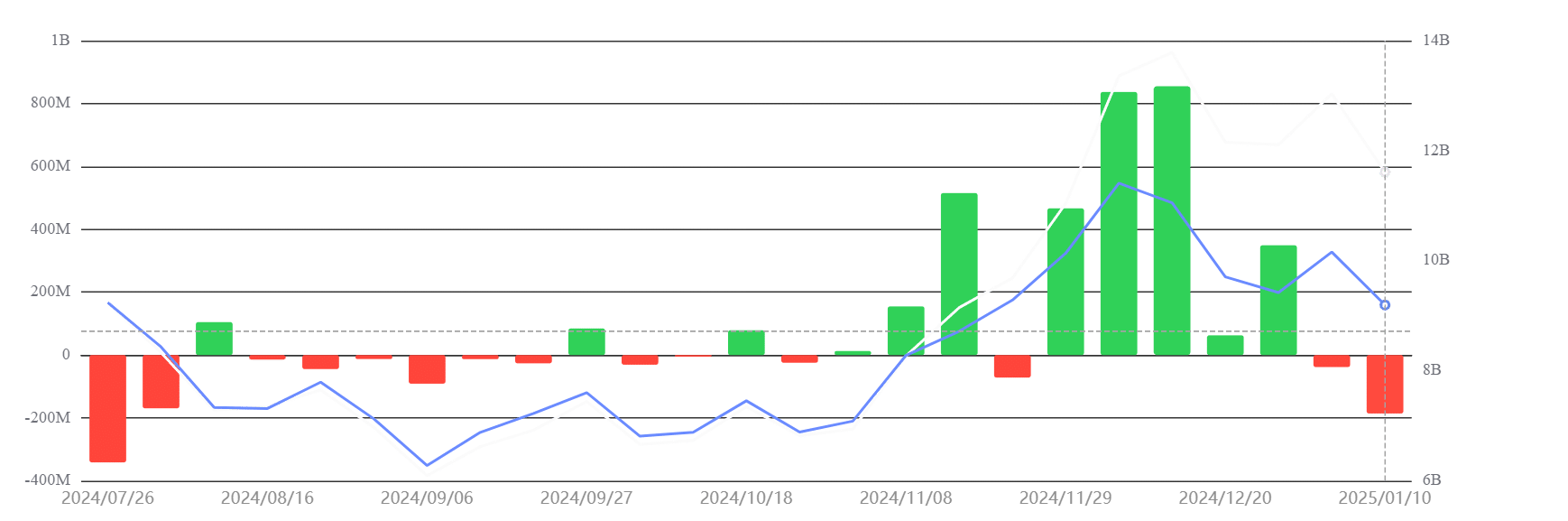

In sharp contrast to Bitcoin’s success, Ethereum ETFs recorded a net outflow of $186 million over the same period. This marks a continuation of Ethereum’s recent struggles to attract investor interest.

Despite this, BlackRock’s ETHA ETF managed to buck the trend, achieving a modest net inflow of $124 million. Meanwhile, Fidelity’s FETH ETF faced substantial outflows, totaling $276 million, further underscoring Ethereum’s challenges.

ETH ETF flow chart analysis highlights this disparity, with inflows waning since late 2024. Concerns around staking risks, Ethereum’s dominance in DeFi, and competitive pressures from other layer-1 networks could be contributing to this decline in sentiment.

The data paints a picture of investors reassessing Ethereum’s long-term prospects.

What BTC ETH ETF trends reveal about market sentiment

The divergence in Bitcoin and Ethereum ETF flows offers valuable insights into investor psychology and market dynamics. Bitcoin’s ability to consistently attract capital signals its growing reputation as a safe-haven asset.

Institutional confidence, spearheaded by major players like BlackRock, reinforces this narrative.

On the other hand, Ethereum’s performance raises questions about its future. Although it remains the second-largest crypto asset, it has struggled to keep up with BTC, and there is growing competition.

As Bitcoin solidifies its position, Ethereum faces mounting pressure to address these concerns and regain its footing.

Broader implications for the crypto market

These BTC and ETH ETF trends are not just numbers; they reflect broader market shifts. Bitcoin’s strong inflows highlight its potential to serve as a hedge against volatility, capturing both institutional and retail attention.

For Ethereum, the outflows suggest a need for clearer narratives to build confidence as a viable alternative asset class.

BlackRock’s dominance in both Bitcoin and Ethereum ETF markets underscores the growing influence of traditional financial institutions in the crypto space. This trend signals a maturing market but also raises questions about the decentralization ethos that has long defined cryptocurrencies.

– Read Bitcoin (BTC) Price Prediction 2025-26

The latest ETF data highlights a tale of two cryptocurrencies. Bitcoin’s strong inflows reaffirm its position as the dominant force in the market, while Ethereum’s struggles emphasize the challenges it faces in maintaining investor confidence.

As crypto evolves, ETF flows will remain a critical barometer of sentiment and a guide to understanding the shifting landscape.